Steel shortage

Our current challenge

Steel shortage

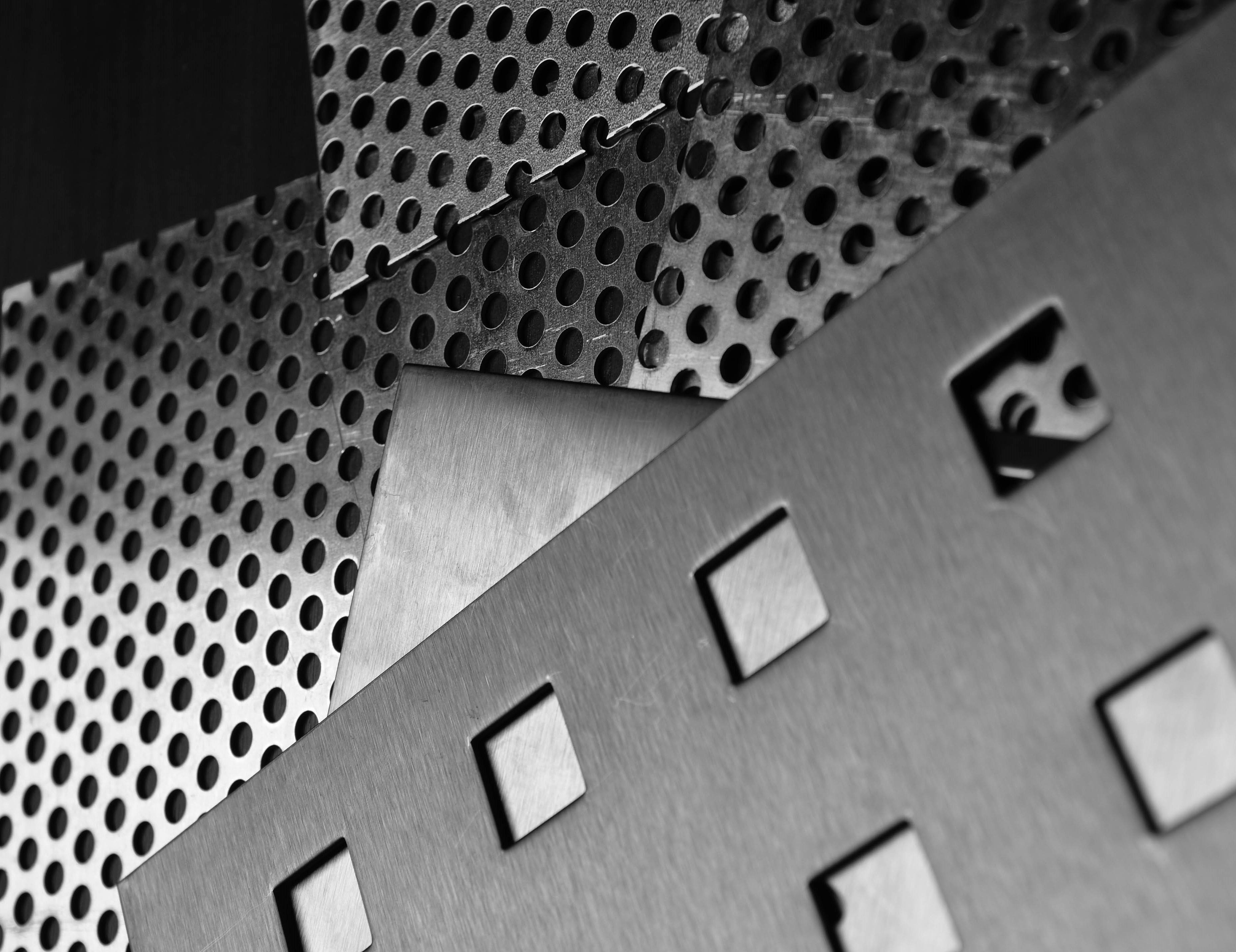

We have been active in the metal industry for over 35 years. At the moment we are dealing with a phenomenon that we have never experienced before in this form in all these years: Steel shortages. Normally we have material in stock for several weeks, so that normal fluctuations on the procurement side can be compensated. Based on our experience, we had a balanced relationship between storage capacity and production.

Now the situation is different. Steel is not only difficult to obtain, but has also become significantly more expensive. Our suppliers are already prioritizing deliveries to regular customers and customers with certain minimum purchase quantities. This is understandable, but little consolation for those who do not (or no longer) have stock to fall back on.

Limited flexibility

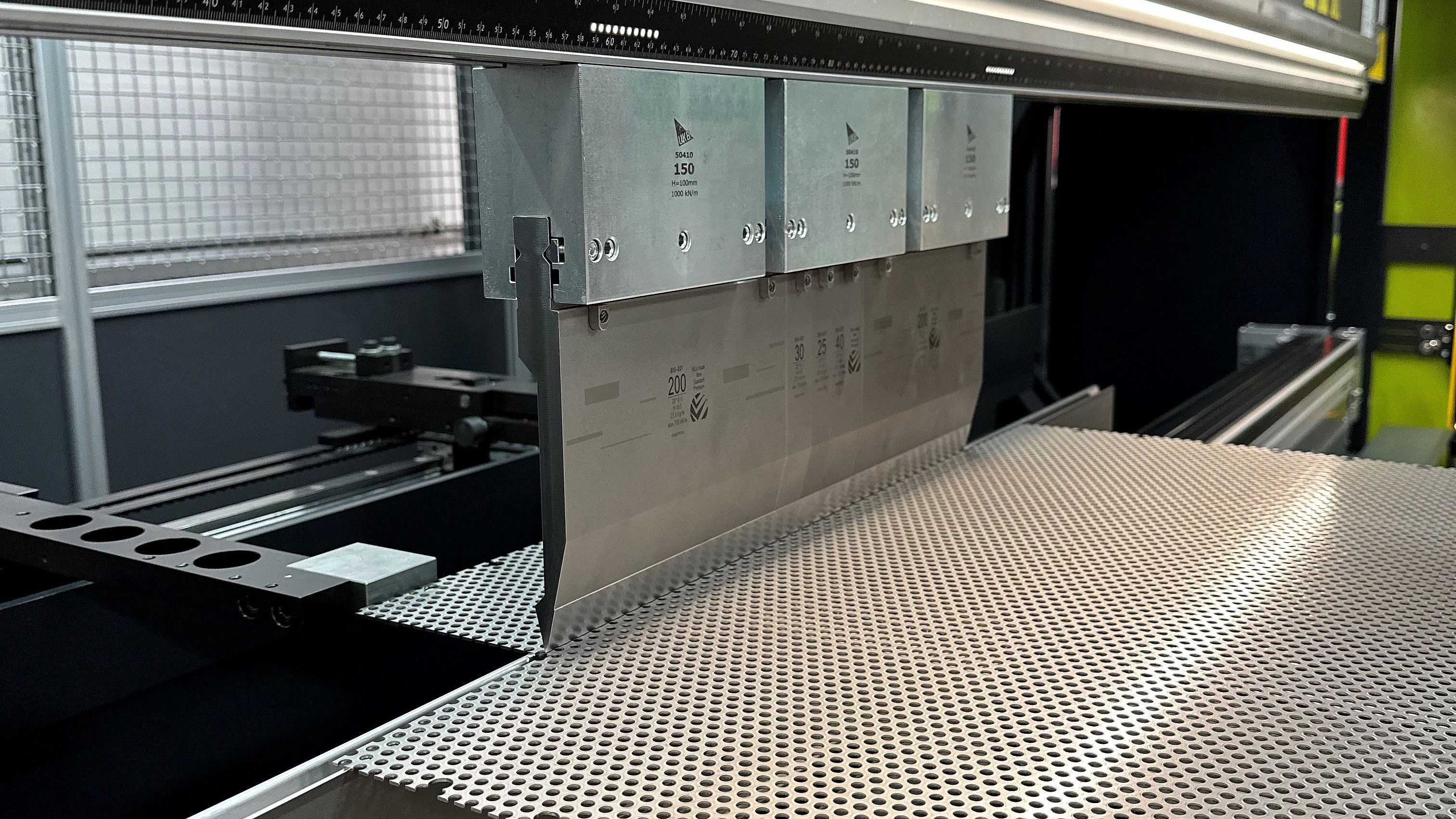

We are also considering how to deal with the issue of shortages. It becomes problematic when projects have been planned for the long term and the customer relies on price stability and on-time delivery. As in the case of our SCS Security Cage Systems, for example. Our security cages for the physical protection of server systems in data centres and companies have a specific planning period and production phase.

We are currently having to put short-term requests on hold in order to be able to service long-term commitments. This hurts us because we are known for our flexibility, but now our usual level of service is tied to market conditions.

Steel shortage causes rising prices

We are currently paying almost three times as much for a ton of steel as we did a year ago. In the case of long-term projects, it becomes difficult in the long run to realize orders as agreed. Calculating with an average value will sooner or later no longer cover costs. For other projects, which we calculate on a daily basis as is customary in the industry, we can and must pass on the increased prices. Steel is known as an early indicator for the economy.

Development of the steel sector

As is so often the case, several aspects come together and amplify their effect. From 2018 to 2019, steel production was cut back as the auto industry produced less. Then came the Corona pandemic. In many places, steel mills cut production even further from a low level. In 2020, Germany produced the least amount of steel since the 2009 financial crisis: 35.7 million tons. In 2009, the figure was 32.7 million tonnes of steel.

Due to the pandemic, staff was laid off last year or put on short-time working for a very long time as many orders were cancelled. Since the end of last year, demand for steel has already been rising. But a rapid ramp-up of production is still causing problems. Currently, the automotive industry is ramping up production again, requiring steel in much larger quantities than previously expected. China is a particularly big driver of the situation, with economic growth also unexpectedly high at 18%. The pandemic has also given a massive boost to online trade. Shipping a container from China to Europe often costs 3 to 4 times what it did just a few months ago. In addition, imports are often no longer economical due to import restrictions and high transport costs. The problems in the supply chains are causing delays and sharply rising prices.

Patience and adaptability are required

As a medium-sized company, we have to improvise. Up to now, we have bought our material from local and regional steel traders. But these procurement sources alone are no longer sufficient. We now also buy supra-regionally and still do not get the desired quantity of materials. So we are involuntarily becoming a price driver of local steel demand as well. According to industry experts, the situation will not change for the time being. Some voices from the industry even state that the market will not recover before next year. There is a risk that a positive economic development will be thwarted if demand is not met. The extent to which end consumers will also feel the price pressure will become apparent in the course of the year.

Sources:

www.tagesschau.de/wirtschaft/bis-zu-vier-mal-hoehere-frachtraten-101.html

www.tagesschau.de/wirtschaft/unternehmen/stahlbranche-tiefster-wandel-der-geschichte-101.html